The Udyam Registration Certificate is a government-issued document introduced by the Ministry of Micro, Small, and Medium Enterprises (MSME) in India. It replaces the earlier system of MSME registration known as Udyog Aadhaar. This certificate serves as official recognition of a business entity as a micro, small, or medium enterprise (MSME) under the Micro, Small, and Medium Enterprises Development Act, 2006.

Obtaining the Udyam Registration Certificate is mandatory for all MSMEs in India, and it provides several benefits to registered enterprises, including easier access to credit, subsidies, government schemes, procurement preferences, and various other support measures aimed at promoting the growth and development of MSMEs.

Udyam Registration, introduced by the Indian government, is a crucial step for small and medium enterprises (SMEs) aiming to access a plethora of benefits and incentives. While obtaining the Udyam Registration Certificate is essential, it's equally important to understand how to leverage various government schemes and incentives to maximize its benefits. In this article, we'll explore strategies that SMEs can adopt to make the most out of their Udyam Registration.

1. Stay Informed About Government Schemes:

One of the primary strategies for maximizing the benefits of Udyam Registration is to stay updated about the various government schemes available for registered enterprises. These schemes often include subsidies, tax benefits, credit facilities, and more. Regularly monitor government announcements and engage with relevant authorities to ensure you're aware of all potential benefits.

2. Assess Eligibility Criteria:

Different government schemes have specific eligibility criteria based on factors such as the size of the enterprise, sector, location, etc. Conduct a thorough assessment of your business to determine which schemes you qualify for. Align your business operations accordingly to meet the eligibility criteria and avail the benefits seamlessly.

3. Optimize Documentation and Compliance:

Many government schemes require proper documentation and compliance with regulations. Ensure that your business maintains accurate records and meets all compliance requirements. This includes timely filing of taxes, adhering to environmental regulations, and other statutory obligations. A proactive approach to documentation and compliance will facilitate the smooth application and approval process for various schemes.

4. Leverage Financial Incentives:

Explore financial incentives offered by the government, such as interest subsidies, credit guarantees, and preferential loan schemes. These incentives can significantly reduce the financial burden on SMEs and provide access to affordable capital for expansion and growth. Work closely with financial institutions and government agencies to take advantage of these incentives.

5. Invest in Skill Development and Training:

Many government schemes prioritize skill development and training initiatives for employees of registered enterprises. Invest in upgrading the skills of your workforce through relevant training programs and workshops. Not only does this enhance the productivity and efficiency of your business, but it also makes you eligible for additional incentives and subsidies under skill development schemes.

6. Foster Collaboration and Networking:

Participating in industry associations, trade fairs, and networking events can provide valuable insights into government schemes and incentives tailored to specific sectors. Collaborate with other registered enterprises to share knowledge and experiences regarding the successful utilization of government support programs. Building strong relationships with industry peers and stakeholders can open doors to new opportunities and collaborations, enhancing your access to beneficial schemes.

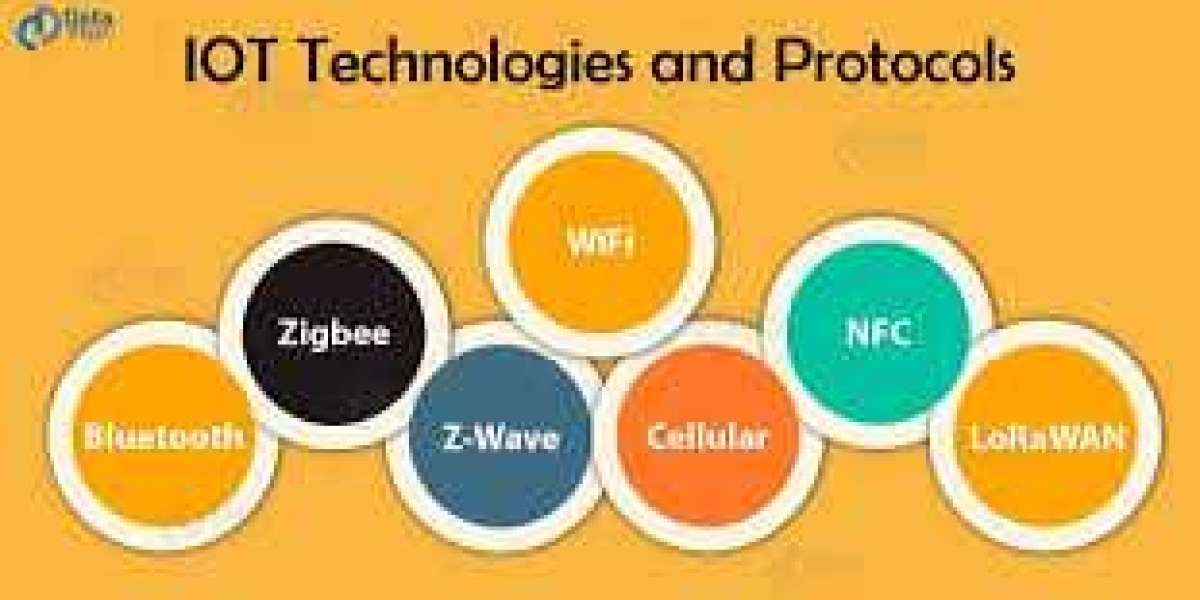

7. Embrace Technology Adoption:

Many government initiatives focus on promoting technology adoption and innovation among SMEs. Take advantage of schemes that offer subsidies or grants for implementing technology upgrades, digitizing processes, or adopting advanced manufacturing techniques. Investing in technology not only improves efficiency and competitiveness but also makes your business more attractive for government support aimed at fostering technological advancement.

8. Diversify Market Reach:

Explore government schemes that support market diversification and export promotion for SMEs. Initiatives like export promotion schemes, trade facilitation programs, and market development assistance can help you expand your customer base beyond domestic borders. Diversifying your market reach not only reduces dependency on local markets but also positions your business for sustained growth and resilience in the face of economic uncertainties.

9. Engage in Research and Development (RD):

Government schemes often provide incentives for research and development activities aimed at fostering innovation and product development. Avail of grants, tax incentives, or subsidized facilities offered under RD schemes to invest in innovation projects. By continuously innovating and improving your products or services, you can enhance competitiveness, create intellectual property assets, and access additional government support for RD-driven enterprises.

Note: You can also read About MSME Registration for Small Business

10. Monitor and Evaluate Performance:

Regularly monitor the performance and impact of government-supported initiatives on your business operations. Evaluate the effectiveness of the strategies implemented and the benefits derived from various schemes. Identify areas for improvement and refine your approach based on lessons learned and feedback received. By maintaining a continuous feedback loop, you can optimize your utilization of government support programs and maximize their long-term benefits for your business.

Conclusion:

In conclusion, leveraging government schemes and incentives through Udyam Registration requires a strategic approach, proactive engagement, and continuous evaluation. By fostering collaboration, embracing technology adoption, diversifying market reach, investing in RD, and monitoring performance, SMEs can unlock the full potential of government support programs and drive sustainable growth. With a clear understanding of available opportunities and effective implementation of strategies, registered enterprises can navigate challenges, seize opportunities, and thrive in today's competitive business landscape.