Introduction

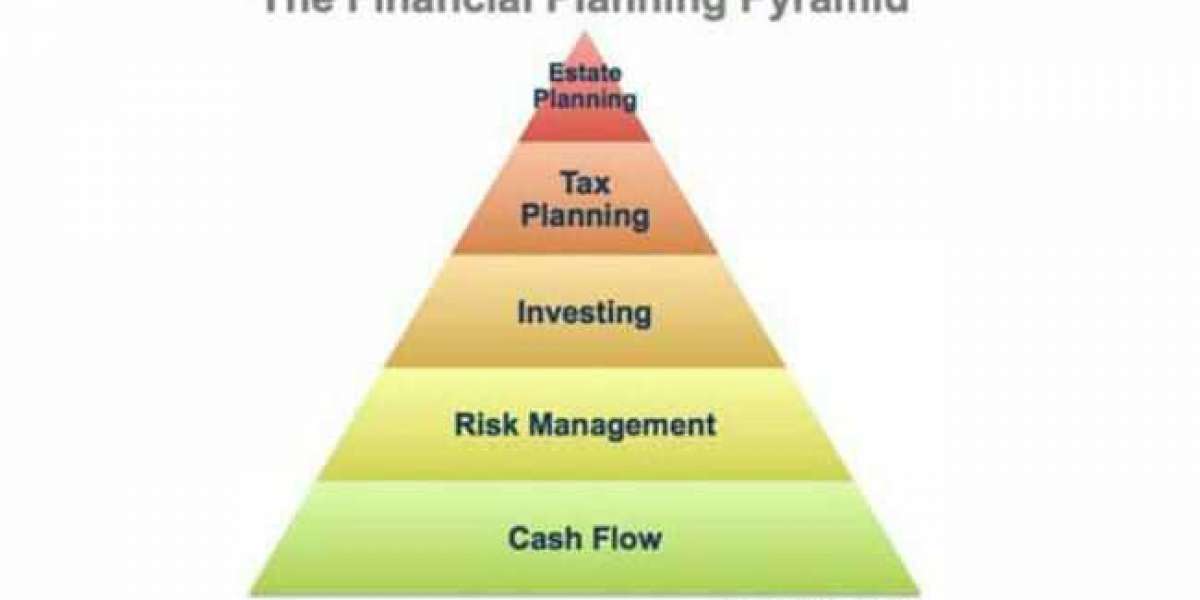

Embarking on the journey of financial planning is akin to steering a ship through uncharted waters. As a business owner or an individual, the primary goal is to safeguard your financial vessel and navigate towards prosperity. Much like a well-thought-out business plan, your financial strategy can be visualized through the lens of the financial planning pyramid. In this exploration, we distill the essence of financial planning into three stages that form the bedrock of a secure and prosperous future.

Wealth Protection: Safeguarding and Preserving Your Current Assets

Preserve Your Existing Wealth: Insurance Plans and Term Policies

In the foundational stage of the financial planning pyramid, the focus is on securing your current assets against unforeseen events. This involves the thoughtful consideration of insurance plans and term policies.

Health Insurance / Mediclaim

Ensuring your well-being and that of your loved ones, health insurance stands as a fortress against medical expenses. It goes beyond minor procedures, extending to coverage for critical illnesses and accidents.

Term Insurance

A crucial component for dependents' financial security, term insurance provides a safety net in case of unforeseen circumstances. It encompasses protection against accidental death, disabilities, and critical illnesses.

Save Money for Contingencies: Emergency Fund

Building a financial pyramid requires a solid base, and an emergency fund is the cornerstone. This fund, covering six months of living expenses, shields you from tapping into investments during unexpected situations.

Wealth Accumulation = Risk-Free, Low to Moderate, Retirement Planning, and Passive Income

Moving up the financial planning pyramid, we transition to wealth accumulation. This involves diversifying income into avenues with lower risks, contributing to retirement planning, and exploring sources of passive income.

Fixed Deposits (FD)

A traditional yet reliable option, fixed deposits offer stable returns ranging from 6% to 7%. They serve as a channel for substantial savings.

National Pension System (NPS)

Once favored by government employees, NPS has gained popularity. With flexibility in risk allocation and attractive tax benefits, it emerges as a prudent choice for retirement planning.

Public Provident Fund (PPF)

A secure retirement scheme catering to self-employed individuals, PPF offers tax-free interest returns. Contributions also qualify for tax deductions, making it a valuable addition to the financial pyramid.

Post Office Saving Scheme

Backed by the government, this scheme provides a lucrative 7.4% interest rate over five years. It stands as a secure avenue for monthly income plans.

Safe Mutual Funds

Not all mutual funds involve high risks. Options like large-cap, blue-chip, multi-cap, and flexi-cap funds offer stable returns, providing a balance in wealth accumulation.

SustVest for Passive Income

Introducing a unique approach to passive income, SustVest offers a remarkable 15% Internal Rate of Return (IRR). Beyond financial returns, it contributes to environmental preservation through rooftop solar energy.

Wealth Distribution: Allocating Funds for Long-Term Recovery

In the pinnacle of the financial planning pyramid, attention turns to wealth distribution. This involves strategic investments in high-risk, high-return avenues, laying the groundwork for property development and succession planning.

With a stable passive income from wealth accumulation, consider ventures like real estate or valuable artifacts. This approach not only secures your financial future but also creates a lasting legacy.

FAQ

How crucial is health insurance in financial planning?

Health insurance plays a pivotal role in safeguarding against medical expenses, ensuring financial stability during unforeseen health crises.

Why is an emergency fund essential?

An emergency fund acts as a financial safety net, preventing the need to dip into investments during unexpected circumstances such as job losses or prolonged illnesses.

What sets SustVest apart in passive income options?

SustVest offers a unique blend of a 15% IRR, monthly interest returns, and environmental contribution through rooftop solar projects.

Conclusion

In the intricate dance of financial planning, the financial planning pyramid emerges as a guiding choreographer. From safeguarding existing wealth to accumulating it through strategic investments and finally distributing it for long-term recovery, each stage contributes to a harmonious and secure financial future. With a human touch, thoughtful planning, and a keen eye on the pyramid's layers, you can navigate the unpredictable waters of financial well-being and leave a legacy that withstands the test of time.