As banks and financial institutions are transferring their core applications and operations to the cloud network, the requirement for security solutions is increasing at a significant pace. The surging shift toward the cloud platform is attributed to the rising need for a personalized banking experience, burgeoning demand for mitigating the risks associated with traditional technologies, growing focus on reducing their capital expenditure, and escalating need for real-time analysis of the large volume of data. The increasing usage of cloud platform has augmented the chances of cyberattacks, as the data is stored at remote locations.

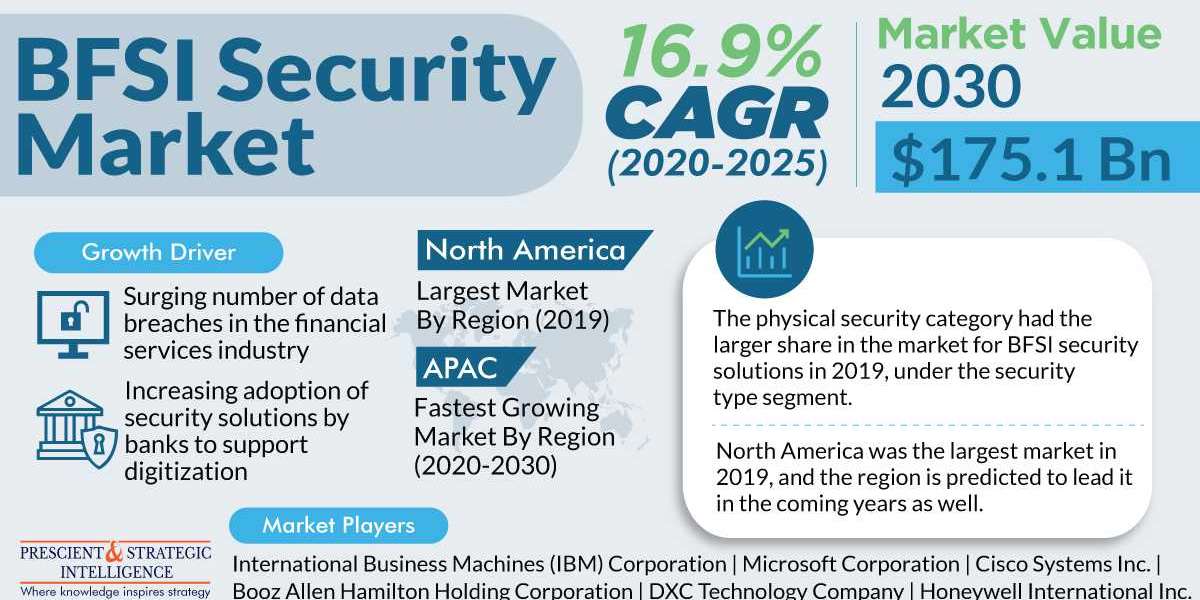

Moreover, the surging adoption of the internet of things (IoT) technology in the banking, financial services, and insurance (BFSI) industry is expected to drive the BFSI security market at a CAGR of 16.9% during the forecast period (2020–2030). The market was valued at $31.3 billion in 2019 and it is projected to reach $175.1 billion revenue by 2030. IoT plays a vital role in enhancing the security of banking and financial institutions by helping such organizations in tracking the crime location, monitoring surveillance systems from remote areas, and detecting and identifying the devices used for data breaches.

In recent years, security solution providers have been emphasizing on partnerships, mergers and acquisitions, and product launches to reach out to more customers. For instance, in August 2019, McAfee LLC, a U.S.-based security service provider, announced the acquisition of NanoSec Co. With this acquisition, the former aims to strengthen the container security capabilities of McAfee MVISION. This will, therefore, allow customers to speed up the application delivery and improve security and compliance of multi-cloud and hybrid deployments.

The security type segment of the BFSI security market is divided into physical security and information security. Under this segment, the physical security category generated the higher revenue in 2019. Whereas, the information security category is projected to register the faster growth during the forecast period. The information security category is further classified into identity and access management, risk and compliance management, unified threat management, data loss prevention, encryption, and antivirus. Among these, the encryption category held the largest share in 2019, due to the increasing fraudulent activities in the payment area, owing to the surging volume of electronic payments.

According to PS Intelligence, North America has emerged as the largest consumer of BFSI security solutions in the recent past and it is expected to maintain the lead in the coming years. Of the North American nations, the U.S. dominated the region in the past and it will continue to do so in the foreseeable years. This can be attributed to the increasing adoption of vulnerability management and cyberattack mitigation solutions by banking and financial organizations and soaring investments being made by these firms in upgrading their information and physical security infrastructure in the country.

Whereas, the Asia-Pacific (APAC) BFSI security market is expected to exhibit the fastest growth during the forecast years, due to the escalating IT investments being made in India and China, growing adoption of advanced technologies by financial institutions, and surging prevalence of fraudulent activities in the region. In 2019, China held the largest share in the APAC market, due to the rising focus of industry players on developing broader security systems by offering intruder alarm systems, access control systems, and various physical security information management (PSIM) systems in banks and financial organizations in the country.

Thus, the rising adoption of cloud and IoT technologies will fuel the requirement for security solutions and services in the BFSI sector in the coming years.