Get the latest insights on price movement and trend analysis of land cost in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East Africa). Understanding the intricacies of land cost prices is crucial for various stakeholders, from investors to developers, as it forms the bedrock of real estate investments and industrial developments. In this comprehensive guide, we delve into the nuances of land cost prices, examining trends, forecasts, and the key factors influencing this crucial aspect of economic development.

Definition of Land Cost:

Land cost refers to the monetary value associated with acquiring or leasing land for various purposes, including commercial, industrial, residential, and agricultural use. It encompasses factors such as location, accessibility, zoning regulations, and market demand. The price of land can vary significantly based on these factors and prevailing market conditions.

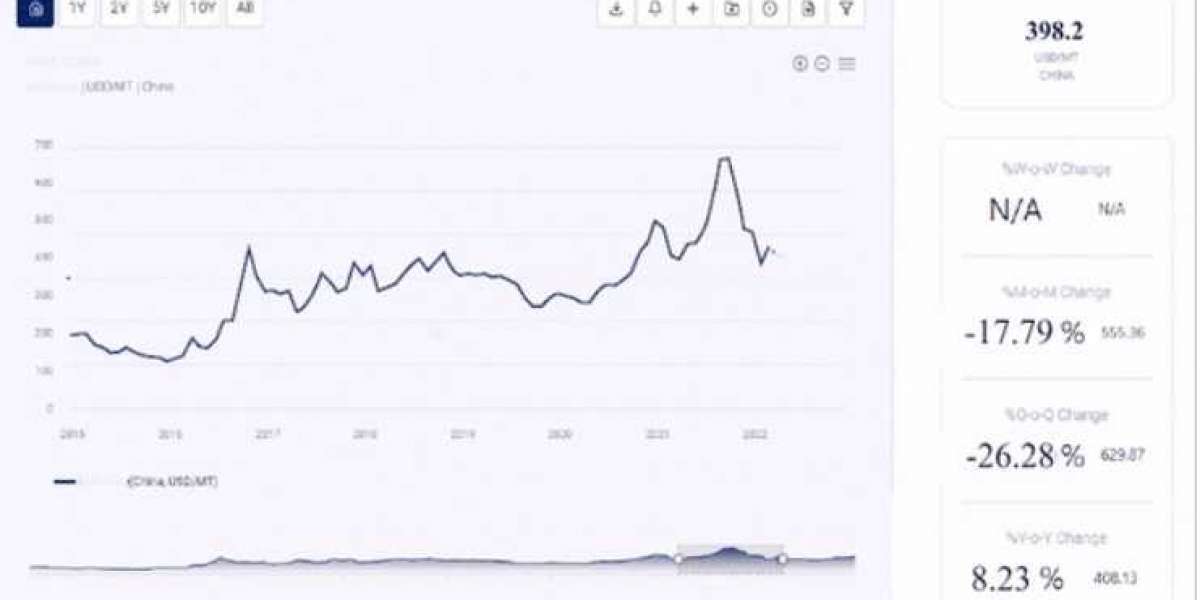

Key Details About the Land Cost Price Trend:

The trend of land cost prices is influenced by a myriad of factors, including economic growth, population density, urbanization, infrastructure development, and government policies. In recent years, global urbanization has been a significant driver of land cost price trends, particularly in emerging economies where rapid urban expansion is occurring.

Request for Real-Time Land Cost Prices: https://www.procurementresource.com/resource-center/land-cost-price-trends/pricerequest

In regions such as Asia and Africa, burgeoning populations and rapid urbanization have led to increased demand for land, resulting in upward pressure on prices. Conversely, in mature economies like Europe and North America, land cost prices may exhibit more stability or even decline in certain areas due to factors such as urban redevelopment, zoning regulations, and market saturation.

Technological advancements and innovations in construction techniques also play a role in shaping land cost price trends. For example, the adoption of sustainable building practices and the rise of smart cities can impact the value of land by influencing demand patterns and development preferences.

Industrial Uses Impacting the Land Cost Price Trend:

Industrial uses have a significant impact on land cost prices, especially in areas designated for manufacturing, logistics, and warehousing activities. The availability of land suitable for industrial development, proximity to transportation networks, and access to skilled labor are key determinants of industrial land prices.

In recent years, the growth of e-commerce and the expansion of global supply chains have fueled demand for industrial real estate, driving up land cost prices in logistics hubs and distribution centers. Additionally, emerging industries such as renewable energy, biotechnology, and advanced manufacturing are reshaping the industrial land market, creating new opportunities and challenges for investors and developers.

Key Players:

The landscape of land cost prices is shaped by various stakeholders, including real estate developers, investors, government agencies, and urban planners. Real estate developers play a crucial role in identifying investment opportunities, acquiring land parcels, and developing properties that meet market demand.

Investors, ranging from institutional funds to individual speculators, allocate capital to land assets based on factors such as risk appetite, return expectations, and market conditions. Government agencies and urban planners are responsible for regulating land use, zoning ordinances, and infrastructure development, which can directly influence land cost prices.

Conclusion:

In conclusion, understanding the dynamics of land cost prices is essential for making informed investment decisions and driving sustainable economic development. By analyzing price trends, forecasting future developments, and identifying key factors influencing land values, stakeholders can mitigate risks and capitalize on opportunities in the real estate market.

Procurement resource such as land cost indices, market reports, and industry surveys provide valuable insights into current market conditions and future projections. By leveraging these resources and staying abreast of market trends, stakeholders can navigate the complexities of the land cost landscape and achieve their investment objectives. Whether you're a developer seeking prime development opportunities or an investor looking to diversify your portfolio, a comprehensive understanding of land cost prices is indispensable in today's dynamic real estate market.